Award-winning PDF software

McKinney Texas W-9 Form: What You Should Know

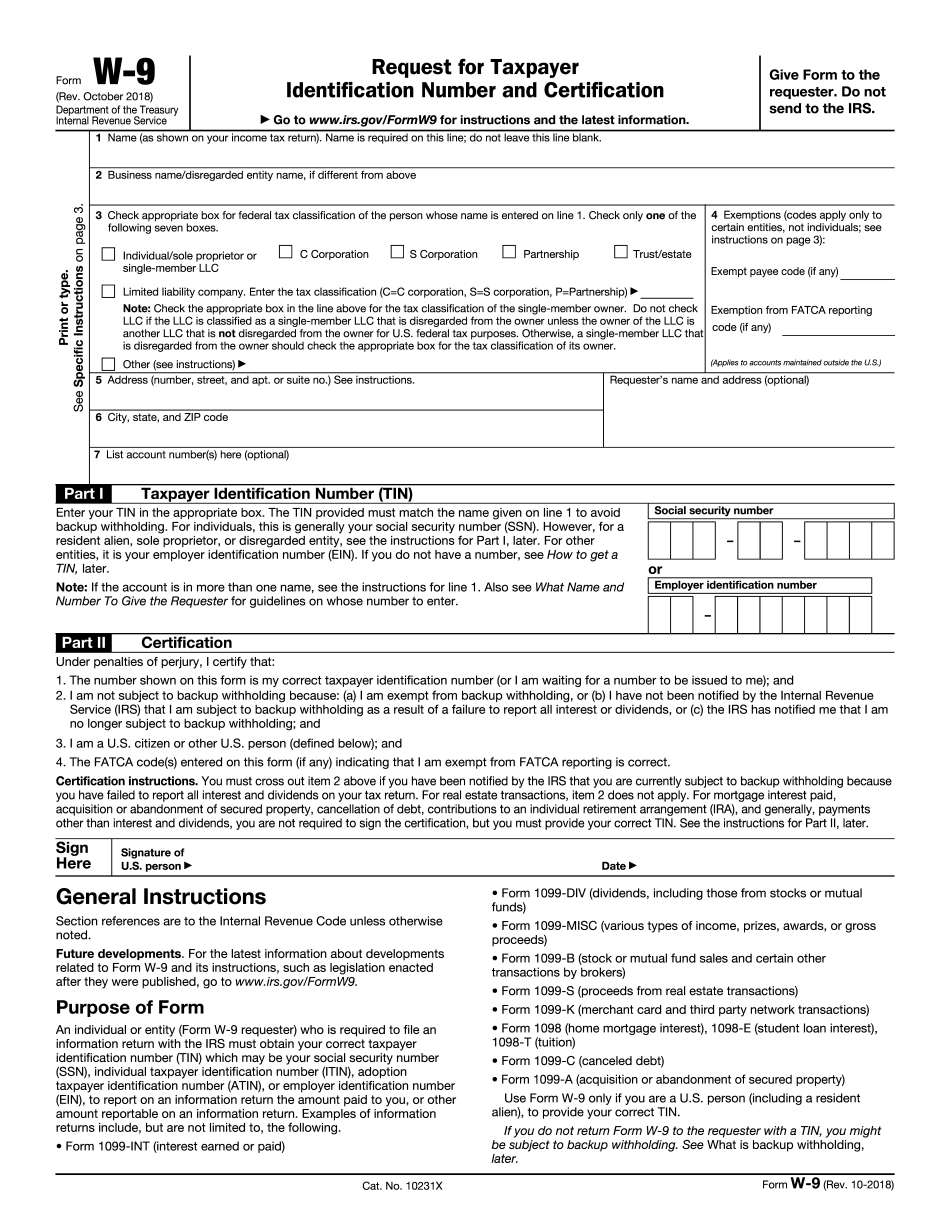

You have to do something different if you want to get your business tax filing done in McKinney Texas. McKinney, TX Vendor Guide For the best possible business tax reporting for small businesses in McKinney, TX you need to know the following: • Have a plan that works for you. McKinney's municipal government is a limited liability company. Enter the tax classification (C=C corporation, S’S corporation, P=Partnership) ▷. Note: Check the appropriate box in the line McKinney Texas Form 1 (W 11-1) — The City of McKinney Special Service Bureau, Municipal Government Tax Department, and Mayor's Office of Revenue Services, Special Service Form 1 for McKinney, TX — City Clerk's Office. Payment Methods for Forms 1 • The City of McKinney, TX is no longer allowing electronic payments. To pay your property taxes electronically, please use this payment method: Check, Money Order, or Cashier's Check. • In order to properly file Form 1 you will need to provide your valid ID and the property tax form is made with an official City seal. Payment Method & Form McKinney Texas Vendor Guide This is where the real McKinney's come in. The local vendors are your best investment and should be your first focus. Use their product to ensure you have complete knowledge of what is necessary. Learn more about McKinney, TX's vendor network here. Contact us to get involved with our network of vendors! McKinney, TX Revenue Services — City Clerk's Office Tax Rate: 7% For all other questions, please call the McKinney, TX Revenue Services office. City of McKinney — City Clerk's Office 972.765.2555 (Voice) (972.765.4050(TTY) · 972.765.3360 · 972.765.3970 Frequently Asked Questions & Tips • Can the City of McKinney charge higher taxes if there is a property in the city with a higher assessed value? The McKinney tax rate is limited to tax only the assessed value of the tax property to which it applies. The only allowable assessment value is the one for which the taxpayer can submit the tax form. • Can the City of McKinney charge tax by value under certain circumstances? The City of McKinney will not assess more than 25,000.00 per year on a property where the tax rate is in excess of 150.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete McKinney Texas W-9 Form, keep away from glitches and furnish it inside a timely method:

How to complete a McKinney Texas W-9 Form?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your McKinney Texas W-9 Form aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your McKinney Texas W-9 Form from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.