PDF editing your way

Complete or edit your irs form w 9 printable anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export printable w 9 2022 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs w9 form 2022 printable as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your nd w 9 form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare W-9 Form

About W-9 Form

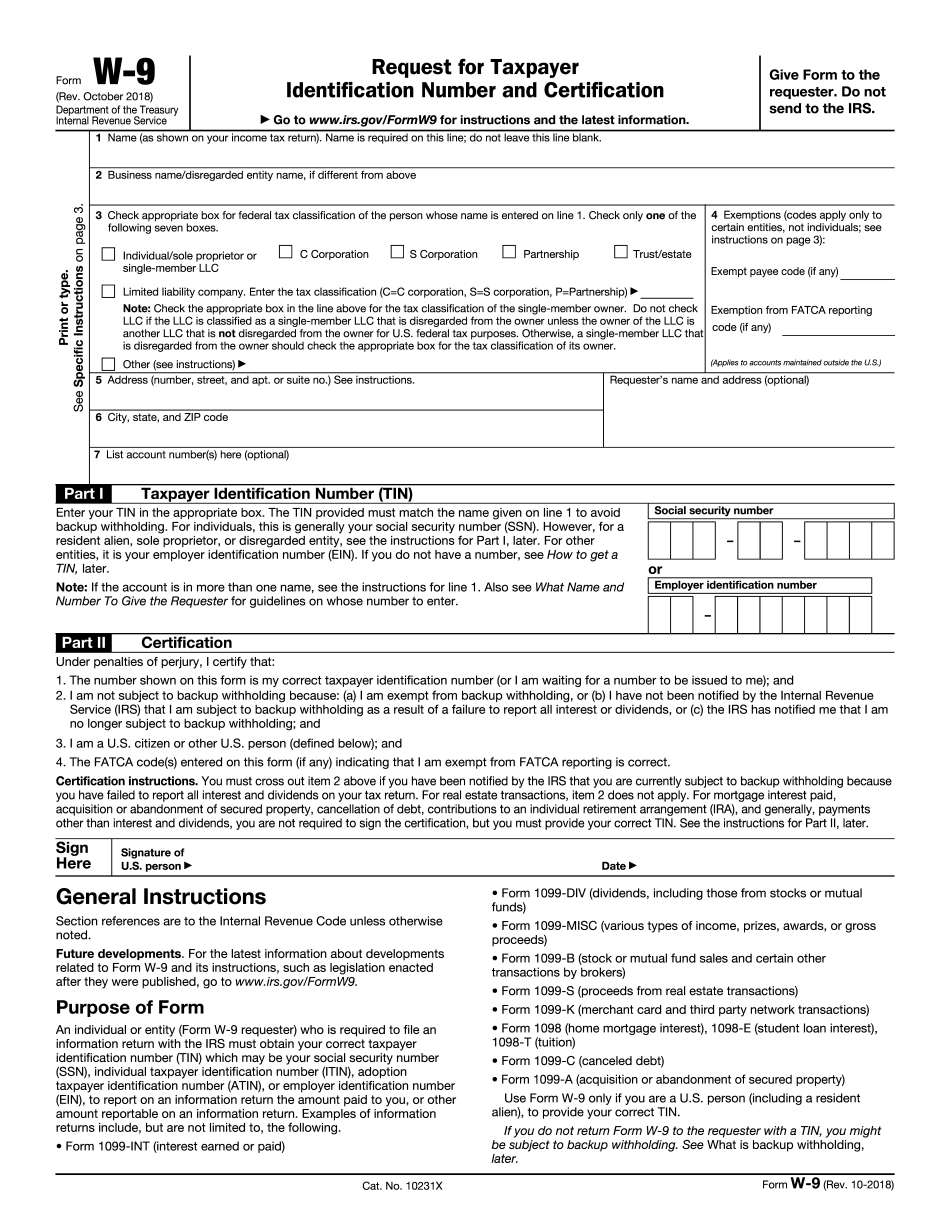

W-9 Form is a document used by the Internal Revenue Service (IRS) to gather information about an individual or entity for tax purposes. It requests the taxpayers full name, address, taxpayer identification number (TIN), and certification of their tax classification. Typically, an individual or business will need to fill out a W-9 Form and provide it to the entity that will be paying them income. The entity can be an employer, a client, or a payer of interest or dividends. The payer uses the information provided in the W-9 Form to report the payments made to the taxpayer to the IRS, and issue them a 1099 Form at the end of the year. In summary, anyone who receives income from an entity that requires tax reporting must fill out a W-9 Form and provide it to the payer.

About Form W-9

The W-9 Tax Form is one of the easiest reports to fill out. You've probably already heard about it, but let's delve into it in a little more detail and analyze all the essential information.

This form is meant to be prepared by freelance workers and other taxpaying residents of the U.S. in order to prtaxpayer ID and the corresponding certification.

According to the IRS website, you are considered a resident for federal tax purposes if you can relate to the following:

- Individual citizen or foreigner who permanently resides in the country.

- A legal entity such as a company, partnership or corporation established or started up in the U.S. or under its laws.

- An inheritance fund (except foreign).

- National trust fund.

The W-9 report is a basic doc for ICs or freelancers, including business-consultants, trade workers and those who hire them. The business asks the contractors to fill out the W-9 if their profit income exceeds $600. The data is meant to be used on a 1099 Information Return. Additionally, it helps financial institutions request a specific customer’s information. Those who are self-employed use it to avoid backup withholding.

Keep in mind not to submit the W-9 to the IRS. Submit it only to the requester.

Did you know?

The Form W-9 can't be signed by a power of attorney unless it specifically states that the agent/lawyer has the right to certify tax documents or forms (with or without copies thereof), or if a form 2848 is provided. If you sign this template on behalf of the organization, you must confirm that you are authorized to sign.

What are the Components of a W-9 Form?

You can get the necessary blank template from your employers or download it for free. But in order to prepare the document correctly and without errors, we recommend using an online sample.

There should be no corrections. If you make a mistake when filling out the sample manually, you will need to start all over again, including the print process. However, this is a waste of time and paper. Electronic filing is more convenient. The W-9 sheet components contain appropriate lines for your answers. You can easily replace incorrect information in an editable document online at any time. Moreover, you can complete this web-based sample from any device and e-sign it in seconds.

Our step-by-step free instructions will help you to fill out the blank W-9 Form faster than ever before.

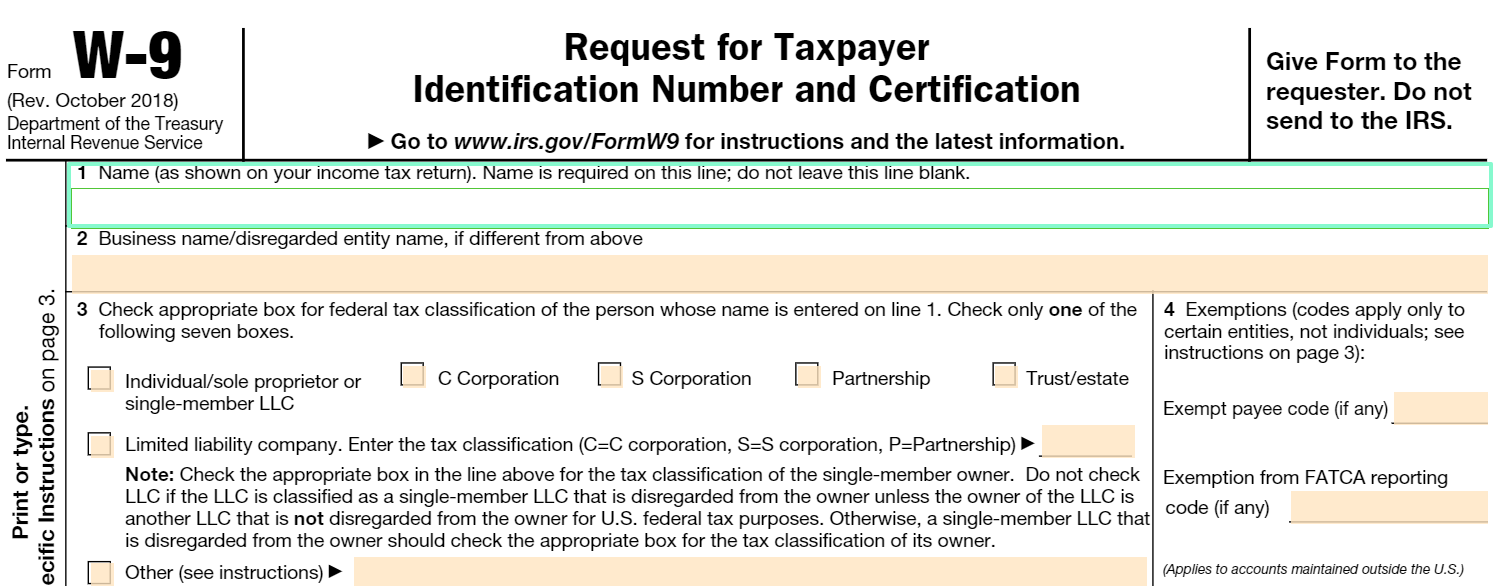

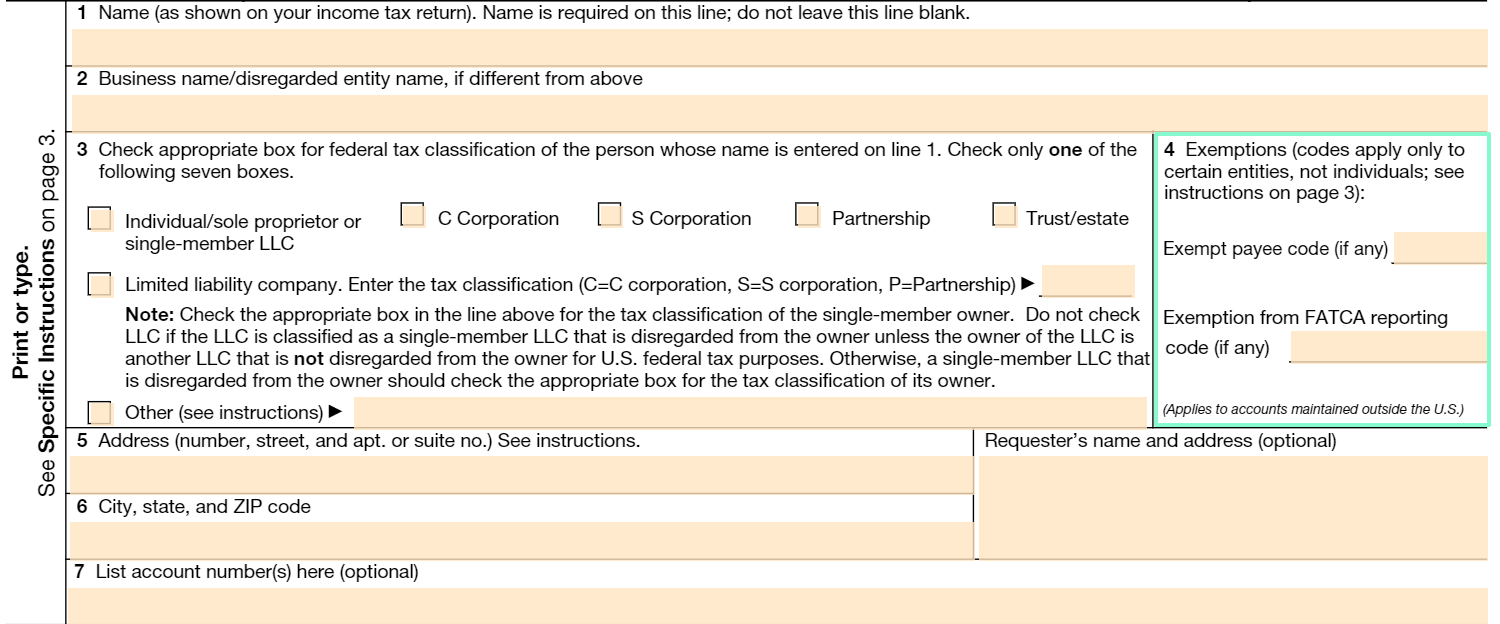

BOX 1

Enter your full name the same as it's presented on your personal income tax return or the corporate name.

Keep in mind, if you change your name you must inform the SSA. If you don’t report it, you must first enter the name as it appears on your social insurance and then type in the new one. This field must be filled in and not left blank.

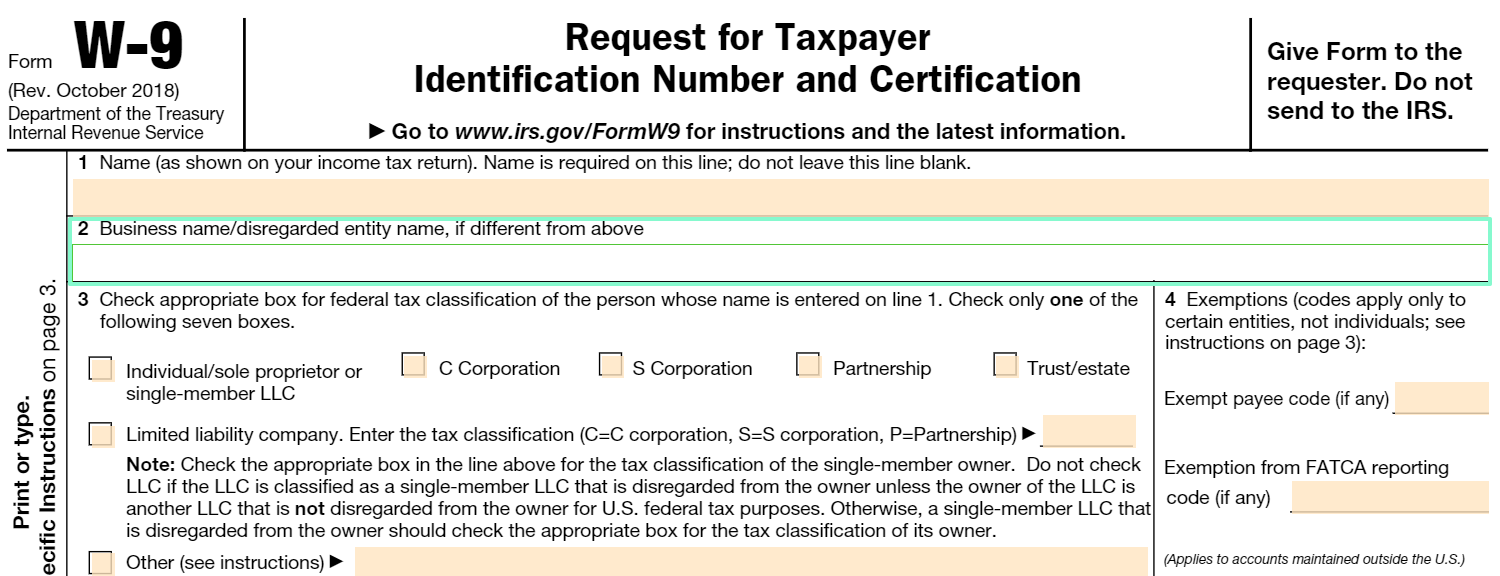

BOX 2

If you have specified the name of the juridical body in the first line, you do not need to repeat it again. Fill it in only if your business and legal name are different. You can also leave this field empty if you are working on your own behalf as a sole contractor but not on behalf of the company or partnership.

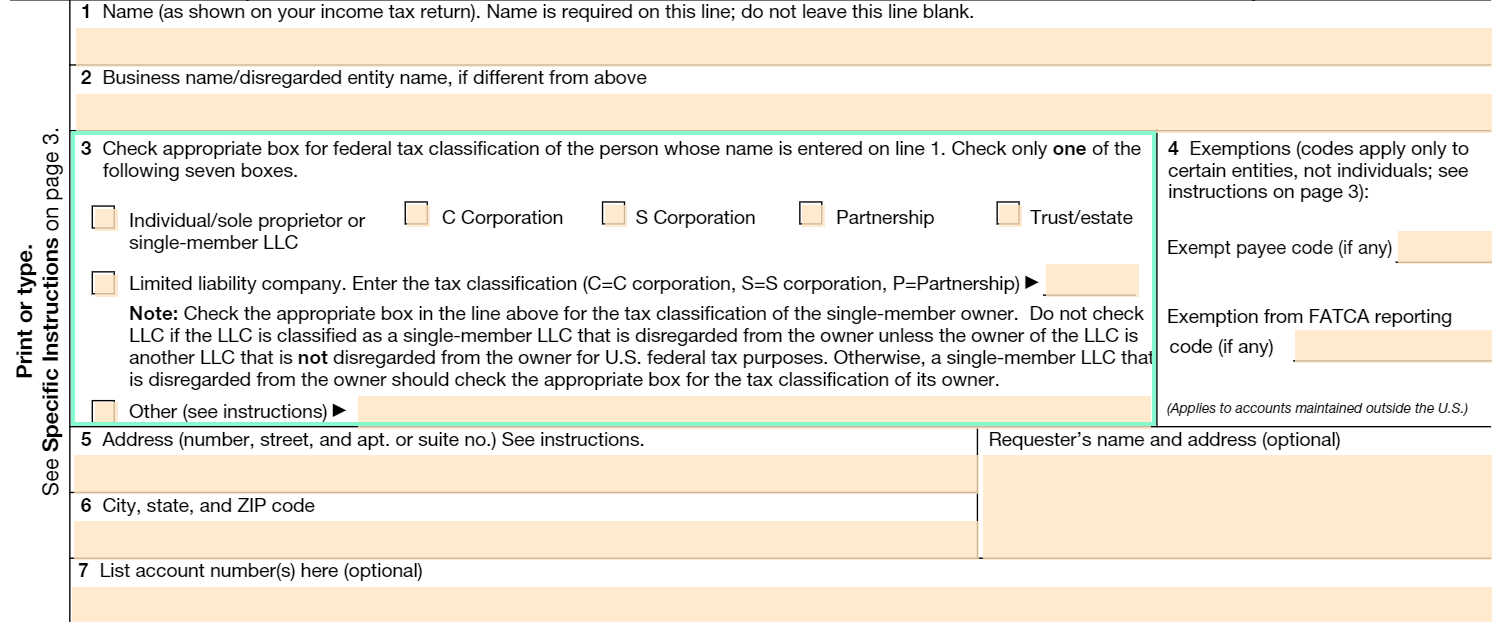

BOX 3

Only one variant should be chosen in this column. If you act and work as a private person, tick the checkmark next to the individual/sole proprietor. If not, choose another appropriate federal tax category. If your company is an LLC, mark the box and indicate the letter C, S or P in the appropriate field. In case you have the Other type, see the instructions.

BOX 4

Prthe exempted beneficiary code and the FATCA exemption code in the appropriate fields. This box is not the obligatory one, but fill out if applicable. Usually, private contractors have no exemptions of additional retention. However, corporations could be exempt. If you have any questions, seek independent tax advice.

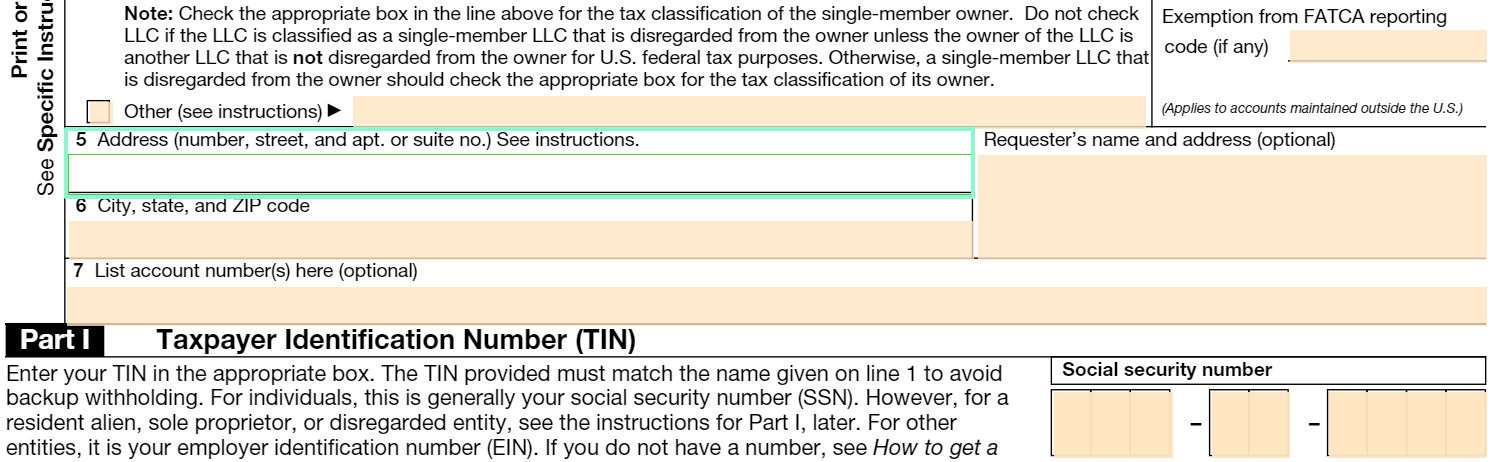

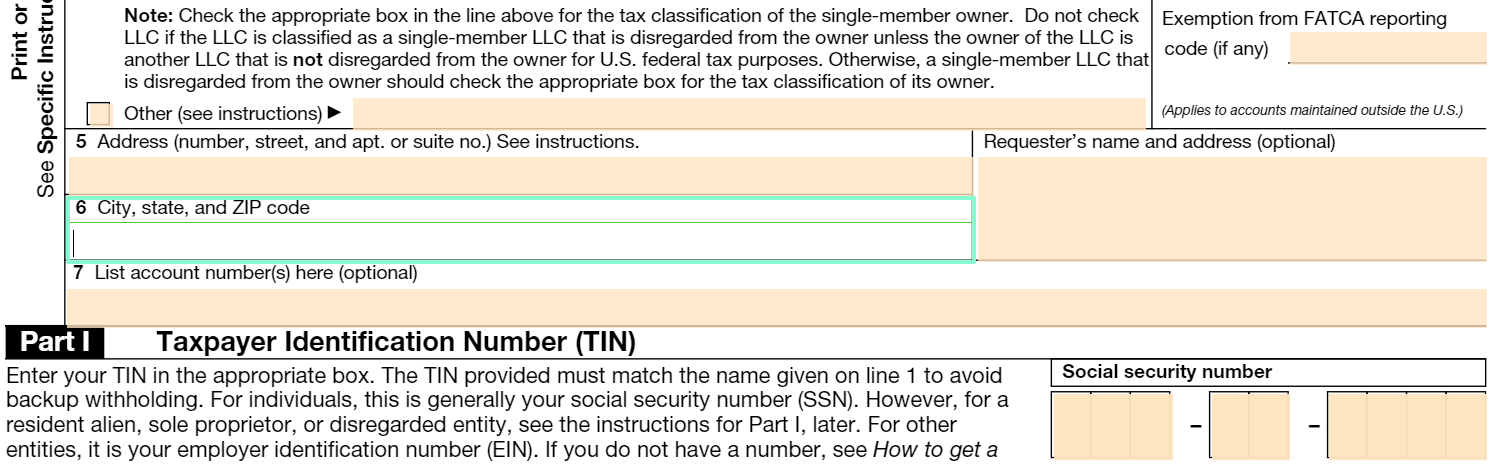

BOX 5

Start to enter your address. For example, 1255 Princeton Ave, apt 93.

If your legal address does not match your place of residential real estate, use the one you put on your tax return.

BOX 6

Continue the address with the city, state and ZIP code as in the example: New York, NY 11256.

BOX 7

It is not an obligatory field. Remember that the IRS Form W-9 will only apply to the mentioned account, and you will need to pranother record for your other accounts.

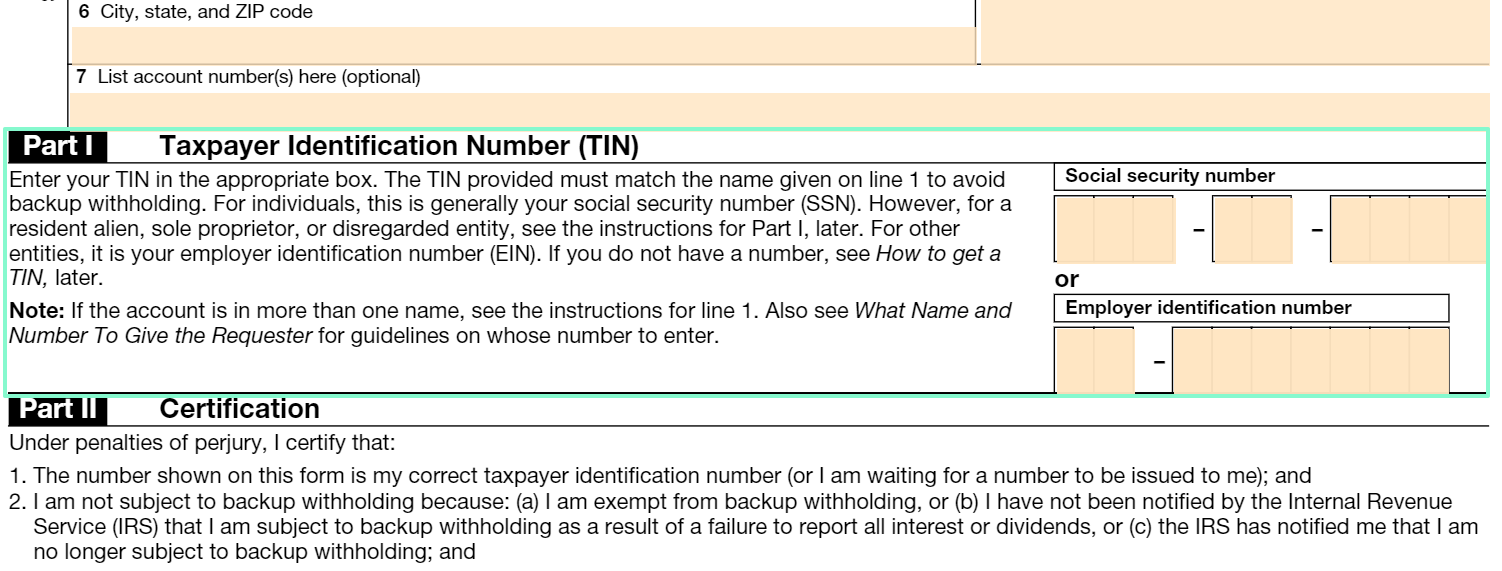

PART I (TIN)

The fillable W-9 is for people who must file an information declaration to obtain the TIN of the recipient of payments (or another person) to avoid backup withholding. A Social Security Number (SSN) acts as a TIN for sole individuals.

For foreign residents, if you do not have an SSN or are not entitled to one, you must enter an ITIN (Individual Taxpayer Identification Number) or an Employer Identification Number in this field — for legal entities, this is the Employer Identification Number (EIN).

Note: A valid U.S. Taxpayer Identification Number (TIN) always will consist of nine digits.

A TIN should not be used as a taxpayer identification number if it:

- Contains anything other than numbers.

- Contains more or less than 9 digits.

- Comprises 9 identical digits.

- Consists of 9 consecutive numerals (in ascending or descending order).

If you do not have a TIN and you intend to apply for one or have already applied for one, please enter “Applied for” in the field. You will have 60 days to pryour TIN numbers to the Bank.

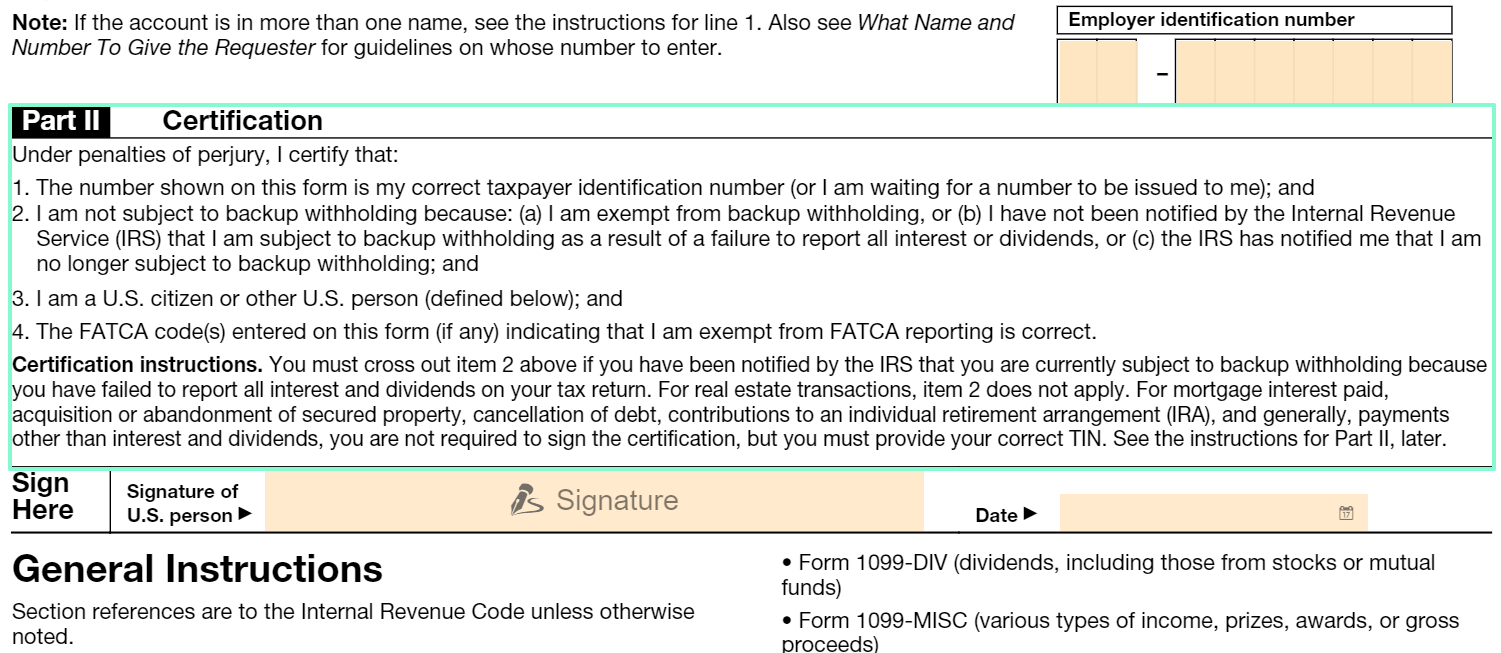

PART II

The purpose of the last fillable box is for the certification of the document.

Please sign these papers and enter the date. If you sign the W-9 tax form on behalf of a legal entity, you must confirm that you are authorized to set the signature.

You can sign electronically. The online PDF editor allows you to create your customized legally binding eSignature.

Pay attention to the certification instructions on the page.

Conclusion

The W-9 tax forms were created by the federal government and are used by company entities you work with to receive information about your tax status. Once completed, the form will be sent directly to the company you cooperate with, not to the IRS. According to tax classification, you can be the subject to backup withholdings if you didn't respond to the request for taxpayer identification.

Businesses need this information to know which tax to deduct from your payments (if necessary) and to submit the appropriate tax forms to the tax authorities on your behalf.

In compliance with the definition of Revenue Service, an independent contractor is a person, corporation or business to present the work when only the result is under control, not all the actions and the process.

For your convenience, you can use the free online sample. An advanced PDFfiller editor offers a set of powerful tools to quickly complete the fillable W-9 form from any device. Moreover, this electronic sample is more secure than filling out a paper one. So your confidential information is protected and stays safe. The preparing and signing process takes minutes and afterward you can email, print or download the file to use in the future.

A payer who cooperates with freelancers will have to submit a Form 1099-MISC at year-end and the W-9 will prthe name, address, and TIN of the contractor. Many recipients send this form to payers each year to give them current evidence about the individuals and businesses they deal with.

Online alternatives allow you to organize your doc management and enhance the efficiency of your respective workflow. Abide by the fast information to be able to finished IRS W-9 Form, refrain from errors and furnish it inside a well timed way:

How to complete a Blank W 9 2025 Printable?

- On the website while using the variety, click Begin Now and go with the editor.

- Use the clues to complete the relevant fields.

- Include your own information and phone data.

- Make confident which you enter right info and figures in best suited fields.

- Carefully take a look at the subject matter in the type as well as grammar and spelling.

- Refer to assist area in case you have any queries or deal with our Guidance workforce.

- Put an electronic signature on the IRS W-9 Form when using the guidance of Sign Tool.

- Once the form is concluded, press Executed.

- Distribute the all set type by way of electronic mail or fax, print it out or help you save with your device.

PDF editor will allow you to make alterations to your IRS W-9 Form from any internet linked system, customize it based on your needs, indicator it electronically and distribute in several methods.